|

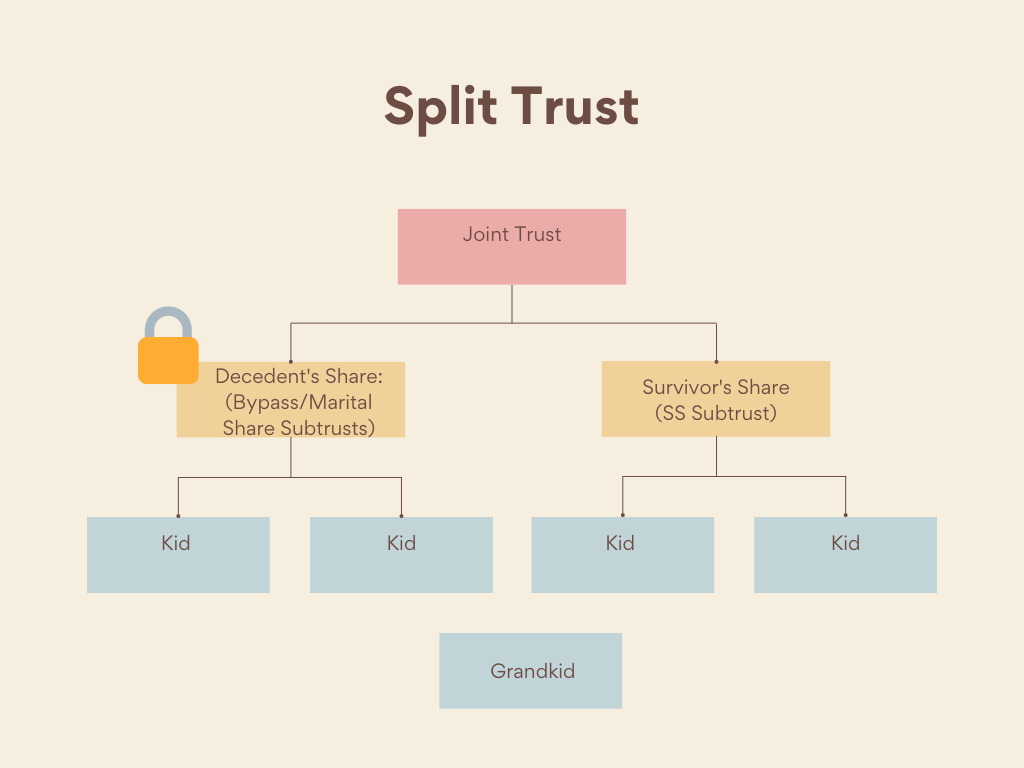

AB Trust: What You Need to Know Introduction Trusts are an important tool for financial and estate planning. AB Trusts are a particular kind of trust. They are often used when a couple wants to control the distribution of their assets after the death of the first spouse to die. This guide will explain the basics of AB trusts, how they work, and the benefits they offer. What is an AB Trust?An AB Trust is a type of trust that allows the spouses/grantors to split the trust into two separate parts after the death of the first spouse. These two parts are known as Trust A and Trust B. The surviving spouse’s assets are transferred to Trust A (usually called the Surviving Spouse’s Trust); while the decedent spouse’s assets are transferred to an irrevocable bypass trust. The surviving spouse then has access to income produced by assets in the Bypass Trust, and potentially some income. Upside

Comments are closed.

|

Details

Archives

June 2023

Categories

All

Let's stay connected! |

RSS Feed

RSS Feed