|

What is Trust Administration?Trust administration is the process of managing and distributing trust assets. Trust assets are those assets that are titled in the name of the trust. For example when you see an asset titled like “David Rose, trustee of the Rose Trust dated May 5, 2020” - you have yourself a trust asset.

If an asset is described any other way it is NOT a trust asset. If the same asset is titled just “David Rose” it does not come under the ambit of the trust instrument. It can come as a shock to some trustees or beneficiaries that an asset is not a trust asset because the outcome of that asset may not be consistent with what you think the decedent wanted. For example, should the family home be titled as “David Rose and Moira Rose, as joint tenants”, after David dies, the home is transferred as a matter of law to Moira… even if the trust instrument provides that the trust assets should be split between David’s children. This can get even more complex if David and Moira die at the same time. Or, if David lists the home as a trust asset but never signs or records a trust transfer deed. As an offshoot - this is why you should consult with an estate planning attorney when you draft your trust. Assets can include real property, personal property such as jewelry and other personal belongings, bank accounts, and investment accounts. The trustee is responsible for managing the assets within the trust, including investing the assets, paying any bills or debts owed by the trust, and lastly - distributing assets to beneficiaries. Responsibilities of a TrusteeThe trustee has a lot of responsibilities. This is why I always tell my trustee clients that they are not obligated to serve as trustee. Let me make this clear - you can say no! Please know that it really is a lot of work. In fact, it so much work that there are professionals whose sole profession is to act as trustee. The Role of the Probate CourtA revocable living trust does not go through probate, which can save time and money for the beneficiaries. However, the probate court still plays a role in the trust administration process. If the trustee fails to properly manage the trust, a beneficiary can petition the court to remove the trustee or take other legal action to protect their interests. Here are the 5 Steps that a trustee must take. These are general guideposts. Every case is different. Step 1: Notifying the Beneficiaries and Taking Inventory Of the Assets (DOD to 3 months) After the decedent dies, the very first thing a trustee must do is contact the heirs beneficiaries to let the heirs and trust beneficiaries know that the trust is now irrevocable, that you are now the trustee. There is very specific language that must be used letting the beneficiaries and heirs know that they have x number of days to bring an action to contest the trust. You’ll note that I am not addressing this letter to just the named beneficiaries of the trust. A trustee must also send this letter all heirs at law - including anyone who may not be mentioned in the trust. This is because 1) the law requires it; and 2) it shortens the time limit for any heir to contest the trust from years to months. The trustee must create an inventory of all the assets held in the trust. This includes identifying and valuing all assets, such as bank accounts, investments, real estate, and personal property. Personal property is often overlooked BUT if you have reason to believe that grandma’s jewelry or art collection is worth over $500, it really should be appraised. The trustee should of course also identify any debts or bills owed by the trust. For any real property, or personal property worth over $500, the property should be appraised. Step 2: Pay Bills and Debts (3-6 months) The trustee must pay any bills or debts owed by the decedent. This includes expenses related to the administration of the trust, such as legal fees and accounting fees. The trustee should also pay any outstanding debts owed. Step 3: Re-Appraise and File Tax Returns (6-9 months) The trustee is responsible for filing any required tax returns for the trust. This includes income tax returns and estate tax returns, if applicable. The trustee should work with an accountant or tax professional to ensure that all tax obligations are met. If the trustee is also the executor, then they are also responsible for filing the last personal income tax return. Property should also be re-appraised at 6 to 9 months post-DOD. Step 4: Fiduciary Accounting ( NLT 1 year) The trustee must maintain accurate records of all transactions for the trust. This includes keeping track of all income, expenses, gains, losses, and distributions. The trustee must prepare a fiduciary accounting report, which is a detailed report of all financial transactions within the trust to present to the beneficiaries. The purpose of the accounting is to disclose all activity of the trust and seek approval of all of those transactions. If the beneficiaries informally approve it, court is not necessary; but, should they not approve it, then a court order is necessary. Step 5: Distribute Assets to Beneficiaries and Distribute The Cash Reserve Once all bills and debts have been paid and tax returns have been filed, the trustee can distribute assets. The trustee must ensure that all distributions are made in accordance with the trust document and any applicable laws. The trustee should also ensure that a cash reserve is set aside. Thus, not all assets should be distributed. The trustee should set aside enough money to pay for any outstanding tax liability that could arise up to three years and beyond after the filing of a return. The trustee should also set aside enough money to pay for tax filing preparation and filing, and legal fees. The cash reserve should really sit for about 12-18 months. After that period, the trustee can safely distribute the reserve to the beneficiaries. Conclusion Trust administration can be a complex process, but with the right guidance, it can be navigated smoothly. Hiring an experienced attorney can help ensure that the trustee fulfills their responsibilities, does not end up with any personal liability, or give beneficiaries, the IRS, or any other creditors any reason to take legal action against them or the trust…. and that the beneficiaries receive their rightful share of the assets. By understanding the trustee's responsibilities, the role of the probate court, and the distribution process, a trustee can work though the administration smoothly and ensure that they can walk away without regret or trepidation. If you have any questions or need assistance with trust administration please contract me. I’m in Los Angeles but handle probate actions throughout the state. You can contact my office at 818-248-2183, or book an appointment online at LawyerCMA.com. Probate is the process by which a court oversees the distribution of a deceased person's assets. Whether a probate petition needs to be filed will depend upon the value of the deceased person’s estate and whether they had a trust.

If the deceased person had a good, funded trust, probate is not going to be necessary; however, if the estate value is above the statutory limit of 166,250, then an action must be filed. Value does not mean net value. It means gross value. If the value is under the threshold limit, probate may not be needed at all, and if it is, then a shorter proceeding may be available. You should consult with an attorney to help you determine the best course of action. Clients always ask - how long will this take? And how much will it cost me? The process takes around 12-18 months. And, the costs will include any filing fees, publication fees, and appraisal fees. In addition, there are executor and attorneys’ fees which are set by statute and not paid until the end of the case. By way of example, for a million dollar estate (and remember the value is based on the fair market gross value NOT the net value), the executor and attorney split around $46,000 in fees. Filing and Petitioning the Court and The Hearing (Steps 1 and 2) The first step in the probate process is to file a petition with the appropriate court. This is typically done in the county where the deceased person lived. The petition will ask the court to appoint an executor or personal representative who will be responsible for managing the estate. The court will also schedule a hearing to review the petition and any objections that may be raised. Hopefully, you will walk away from that hearing with letters which I consider to be the gate openers. With letters in hand, you take responsibility for the estate administration, and are free to contact banks, and other account holders. Prior to those letters, you cannot do much in the way of investigating the deceased person’s assets and liabilities because account custodians will not share information with you. In addition the letters allow you to take control of the assets and eventually distribute and disperse them. It's important to note that there are different types of probate proceedings, depending on the value and complexity of the estate. Small estates may be eligible for a simplified probate process, which can be faster and less expensive. A probate attorney can help you determine the best course of action for your specific situation. Inventory and Appraisal, Creditor Notification and Procedure (Steps 3-4) Once the executor or personal representative has been appointed, they will be responsible for gathering and inventorying all of the deceased person's assets. This includes real estate, bank accounts, investments, and personal property. The assets will need to be appraised by a professional to determine their fair market value. This information will be used to determine the value of the estate and to prepare tax returns. Some assets may be exempt from the probate process, such as property held in joint tenancy, life insurance policies with designated beneficiaries, and retirement accounts with designated beneficiaries. These assets will pass directly to the designated beneficiaries outside of probate. At this time, the executor needs to give notice to any known creditors that there is a probate action to administer the deceased person’s assets. If any creditors step forward, and makes a claim, the personal representative will accept, reject, or partially accept/reject the claim within 30 days of receiving the creditor claim. If a claim is rejected, the creditor has an additional 90 days to file a lawsuit against the estate to recover the alleged claim. Paying Debts and Distributing Assets (Step 5-6) After all of the assets have been identified and valued, the executor or personal representative will need to pay any debts owed by the deceased person, including taxes, funeral expenses, and outstanding bills. Once all debts have been paid, the remaining assets can be distributed to the heirs named in the will or to the deceased person's heirs-at-law if there is no will. Conclusion Probate can be a complex and time-consuming process, but it is necessary to ensure that a deceased person's assets are distributed according to their wishes. By understanding the probate steps involved, you can be better prepared to navigate the process and ensure that your loved one's estate is handled properly. If you have any questions or need assistance with the probate process, please contract me. Again, I’m in Los Angeles but handle probate actions throughout the state. You can contact my office at 818-248-2183, or book an appointment online at LawyerCMA.com. 1/16/2023 Trustee’s Notice: The First Thing A Successor Trustee Should Do After The Death Or Incapacity Of The Initial TrusteeRead Now After the initial trustee passes away, or becomes irrevocable, what must the trustee do? When a trust becomes irrevocable, it means that the trustor can no longer change or terminate the trust. As a result, the trustee of the irrevocable trust is responsible for managing the trust’s assets.

In California, a trustee must follow specific rules and regulations when administering an irrevocable trust. The first thing a trustee must do is send out a Trustee’s Notice. Who Needs To Be Notified? A revocable trust becomes irrevocable by reason of the death of one or more of the settlors, or when there is a change of trustee of an irrevocable trust, the trustee must give notice as provided in that section to each beneficiary of the trust. Also, if the notification is required because of the death of a settlor, notice must be given to the heirs of the settlor. What Does The Notification Need To Say? The notice must be specific and contain the following:

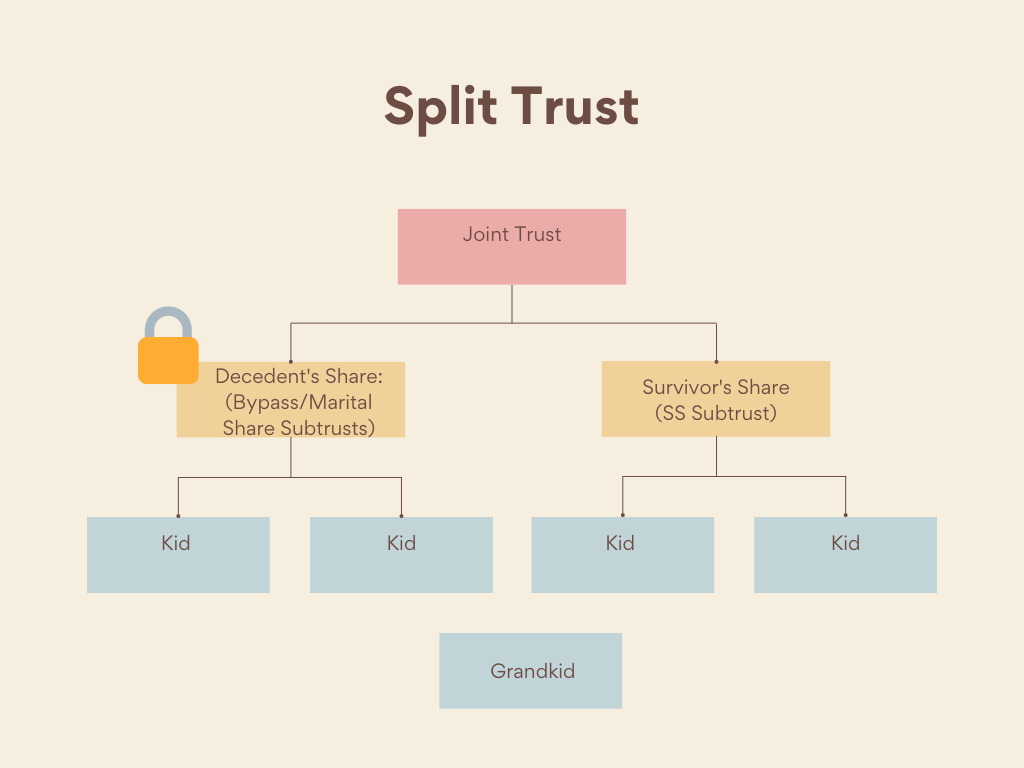

To begin with, the law requires it. In addition, this is a great way to limit the time in which an heir or beneficiary can challenge a trust. This is quite critical information, and will affect the timing of distributions. The notice shortens the statute of limitations for bringing an action to contest the trust to the later of 120 days from the date of notification or 60 days from the time the trust instrument is mailed or delivered during that 120-day period When Does The Notice Need to Be Sent? The successor trustee has 60 days after the death of the initial trustee to give notice. Are you a successor trustee? Contact my office to set up a free consultation to discuss this notice, and other aspects of being a trustee. Let’s come up with a plan! 818-248-2183. Or email me via the below. AB Trust: What You Need to Know Introduction Trusts are an important tool for financial and estate planning. AB Trusts are a particular kind of trust. They are often used when a couple wants to control the distribution of their assets after the death of the first spouse to die. This guide will explain the basics of AB trusts, how they work, and the benefits they offer. What is an AB Trust?An AB Trust is a type of trust that allows the spouses/grantors to split the trust into two separate parts after the death of the first spouse. These two parts are known as Trust A and Trust B. The surviving spouse’s assets are transferred to Trust A (usually called the Surviving Spouse’s Trust); while the decedent spouse’s assets are transferred to an irrevocable bypass trust. The surviving spouse then has access to income produced by assets in the Bypass Trust, and potentially some income. Upside

After you have signed the attorney-client contract, it is time for us to meet for the first time. Prior to our meeting, please securely upload the following to your Clio account. Not all of these documents will apply to your case. If the request does not apply, simply ignore the request.

If you are unable to scan these documents and upload them, please let me know. Please upload the following documents prior to our initial meeting - request documents: 1. All original wills and codicils (if estate plan not prepared by our office). 2. All original trusts and amendments established by decedent (if estate plan not prepared by our office). 3. Most recent bank statements for accounts on which decedent's name appears as either sole or co-owner in any capacity and copy of signature card for each account. Copies of monthly statements. 4. All passbooks and savings certificates on which decedent's name appears. 5. Most recent statements for all mutual fund and stock brokerage accounts. Copies of monthly statements. 6. Certified copies of death certificate if available (no less than 5 copies). In addition, the following information and documents will also be needed, but need not be brought to the initial meeting unless readily available: 1. All IRA and qualified pension benefit documents, including beneficiary designation forms and plan descriptions. 2. Certificates of title ("pink slips") for all automobiles, recreational vehicles, boats, trailers, motorcycles, and airplanes in which decedent had any ownership interest. 3. All life insurance policies and annuity contracts, including beneficiary designation forms. 4. All deeds to real property in which decedent had any interest and copies of any notes or deeds of trust to which such properties are subject. If you do not have a copy of the deed, please supply me with the address. 5. All leases for all real property on which decedent was either the landlord or tenant. 6. Most recent personal income tax return. 7. Copies of all gift, estate, and/or generation-skipping transfer tax returns ever filed by decedent or decedent's spouse at any time in the past. 8. Most recent financial statements and tax returns for any partnership or other closely held business. 9. Copies of any partnership agreements, buy-sell agreements, and corporate records for any partnership or closely held corporation. 10. A list of tangible personal property items that, individually or as a group or collection, have a fair market value in excess of $3000 (e.g., jewelry, art, antiques, or coin, stamp, book, gun, or wine collections). 11. Copies of all bills for expenses of last illness, such as hospital and doctor bills, and an itemized list of all funeral and related expenses. 12. A list of any known debts, liabilities, pending lawsuits, or other claims of or against decedent. 13. Copies of any trust of which decedent was a trustee or beneficiary at the time of death. 14. A list of all safe deposit boxes on which decedent's name appears, by bank and branch, and an inventory of the contents of each. 15. All deeds of trust, notes, or accounts receivable representing payments owed to decedent. 16. All stock certificates, bonds, or other securities. 17. Any other documents that you believe may be important to our understanding of decedent's personal and financial affairs. If you have any questions or if any of this information or documentation is not available by the time set for your appointment, we can discuss this at the time of the appointment. Time is of the essence in these matters, and we would prefer not to delay just because a particular document is not available. Checklist – Preparation For Probate Petition And Hearing

Assets Not Subject To Probate:

If you and I have spoken about your estate planning strategy, you have probably heard me suggest that Biden and the Democrats were going to make some changes to the federal estate tax law. This week, Biden unveiled some proposed changes.

The federal estate tax exemption is currently extremely high at $11.58 million per person. This means that you can leave $11.58 million to your loved ones without estate tax consequence. The biggest surprise is that the estate tax exemption will not change, as previously discussed, according to Biden’s The American Families Plan. That leaves many of us untouched by the estate tax. That's the good news. Now, onto the not so good news. Biden is attempting to remove stepped up basis. This means that currently, when a decedent passes away, the assets they leave behind get a step up in tax basis. In sum, this saves beneficiaries and heirs a lot of money when it comes to selling those assets. It can lessen and even completely eradicate capital gains taxes. Biden’s proposal will eliminate that step-up. Since this will result in a significant tax for many of us, there are thankfully some exceptions. Gains of less than $1 million, or $2 million, per couple would not be taxed. Let's not hit the panic button yet. This proposal is not law yet. The Democrats have a slim margin and this would be a hit for a lot of citizens. So, the answer right now is to wait and see... Proposition 19 is one complicated piece of legislation. It is difficult to explain without a brief discussion of the backstory. County assessors administer the assessment of your real property. Proposition 13, passed in 1978, limits the property taxes to 1% of the assessed value of the property. It also limits assessment to a 2% increase unless there is a change in ownership or construction – in which case there is an assessment.

Propositions 58 and 193 exclusions were also created which allowed property to transfer between family members including parents and children (58); grandparent to grandchild (193). Propositions 60 and 90 allow homeowners 55+ years of age to sell their primary residence and transfer the base year value of that property to a replacement residence if certain conditions are met. Proposition 60 applies to intra-county transfers, while Proposition 90 applies to inter-county transfers under certain conditions The year that the property is assessed for property tax purposes is referred to as the “base year.” The assessed value is generally the sales price. Thus, if grandma and grandpa bought their home for $300,000, the base year value is $300,000. Property tax will be calculated based upon $300,000. If grandma and grandpa sold that same property in 2021 for $1,5000,000 the property would be assessed at $1,500,000. Prior to Proposition 19 grandma and grandpa could leave the home to a grandchild, and the house would be excluded from reassessment, resulting in an enormous savings on property tax. Now that Proposition 19 is in effect, the grandchild would not be excluded, subject to some exceptions. The County would assess the property upon the transfer to the grandchild, except under some very narrow circumstances. Questions on how this may affect your home or homes? Call me for a consultation. As of last week, President Biden took office. With the administration change, there will also likely be a change in federal estate and gift tax policies.

President Biden is expected to reduce the tax exemption for estates and gifts and increase the tax rate on transfers. With a Democratic majority in both houses, it is highly possible Biden’s plans will become law. Even though the White House will focus on more pressing matters like the pandemic, it’s important to keep in mind the kinds of changes you should expect: 1. A decrease in the federal estate tax exemption. We have long enjoyed an extraordinarily high estate tax exemption of $11.58 million per person. Thus, anyone can pass on $11.58 million in assets to beneficiaries without triggering any federal estate tax. Married couples can pass along double that amount - $23.6 million - to their beneficiaries. Although this legislation was already expected to “sunset” (or fade out) on December 31, 2025, it is likely that Biden will work with Democrats on lowering the current exemption limit now, and not later and will likely make an aggressive change to the exemption. Biden has proposed lowering the exemption to $3.5 million estate with a $1 million gift. This will affect significantly more people than the current $11.58 million. 2. An increase in transfer tax. There is also a potential for the applicable tax rate to include an increased top tax rate of 45 percent. 3. Elimination of step-up basis. This change will impact homeowners, and owners of assets like stock shares. Currently, when a person passes away, assets in their estate typically receive a basis step-up in basis upon death. This is significant because capital gains tax is used to calculate capital gains. With a step up in basis, the potential for capital gains is decreased or eliminated. Biden seeks to remove the step-up in value all together. Let us help you plan ahead! Schedule a meeting to discuss your estate planning needs and learn how we can help you save for the future! Schedule your complimentary consultation HERE. I look forward to seeing you at Estate Planning Meeting #1! Please be sure to upload the following documents to Clio at least two days prior to our meeting.

If you have any other investment or business interests that may not be triggered by any of the above requests, please let me know. |

Details

Archives

June 2023

Categories

All

Let's stay connected! |

RSS Feed

RSS Feed